The Budget will add to the cost of producing food at a time when hard-pressed British farmers cannot absorb it, meaning either the supply chain or consumers will end up bearing the brunt.

The impact on British family farms, already stretched to breaking point after a decade of tightening margins, cost inflation and extreme weather events, could be the final straw for many.

And changes to Agricultural Property Relief (APR) and Business Property Relief (BPR)1, despite repeated assurances from ministers that this wouldn’t happen, put the futures of many family farms and the people who farm them at risk.

Farmers are also reeling from the announcement of a speeding up of the phasing out of old support schemes2, which amounts to a significant cut to farm incomes, at a time when their replacement schemes still leave many farm businesses locked out.

Together with wage rises3 and added costs to businesses that apply across the economy, these policies raise serious questions about the future of British food security and the impact on food supply and prices.

Reacting to the announcements, NFU President Tom Bradshaw said: “This Budget not only threatens family farms but will also make producing food more expensive. This means more cost for farmers who simply cannot absorb it, and it will have to be borne by someone. Farmers are down to the bone and gristle, who is going to carry these costs?

“It’s been a bad Budget for farm confidence, which is already at an all-time low. After today farmers, including tenants, have more uncertainty and more worry, not less.

“When you look farmers in the eye and make them a promise, keep it. The shameless breaking of those promises on Agricultural Property Relief will snatch away much of the next generation’s ability to carry on producing British food, plan for the future and shepherd the environment.

“It’s clear the government does not understand that family farms are not only small farms, and that just because a farm is a valuable asset it doesn’t mean those who work it are wealthy. Let’s not sugar-coat this, every penny the Chancellor saves from this will come directly from the next generation having to break-up their family farm.

“This is one of a number of measures in the Budget which make it harder for farmers to stay in business and significantly increase the cost of producing food.”

There is some good news within the Budget, as those hit by devastating rainfall earlier this year will ‘immediately’ have access to the £60 million Farm Recovery Fund, an increase of £10 million.

The agricultural budget for England has also been maintained4, with Defra confirming this year’s budget to be £2.6 billion to reflect the underspend from the previous government.

Both of these are areas the NFU lobbied ministers hard to agree.

More information:

- The government announced it will reform Agricultural Property Relief and Business Property Relief from April 2026. In addition to the existing nil-rate bands, the 100% rate of relief will continue for the first £1 million of combined agricultural and business assets and will be 50% thereafter.

- The government has announced that they are accelerating the end of the direct payment phaseout. The fastest reductions in subsidies will be for those who received more than £100,000 in direct payments in 2020 as these businesses will receive no more than £8,000 in 2025.

- The government has confirmed the National Living Wage increase of 6.7%, making it £12.21. The National Minimum Wage for 18 to 20 year olds will increase by 16.3% to £10.00 per hour.

- The current agricultural budget for England is £2.4 billion.

Chilterns Neuro Centre Marks 40 Years with Summer Appeal

Chilterns Neuro Centre Marks 40 Years with Summer Appeal

Callum Anderson MP marks one year in office

Callum Anderson MP marks one year in office

Antisocial Behaviour Awareness Week – 30 June to 6 July

Antisocial Behaviour Awareness Week – 30 June to 6 July

Serious injury collision – Haddenham

Serious injury collision – Haddenham

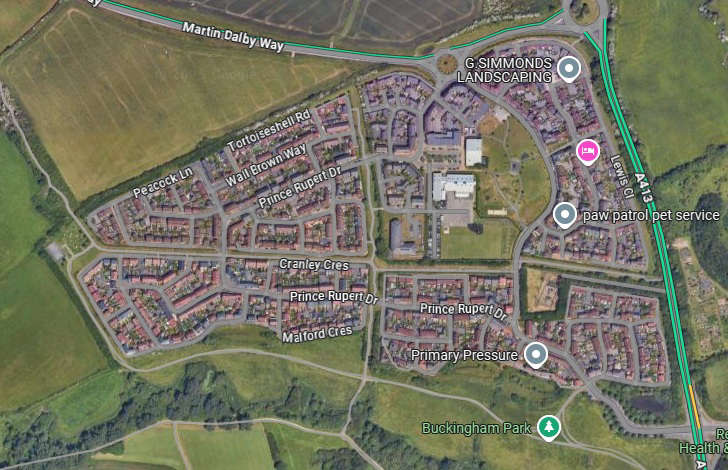

A 41-year-old man from Watermead, arrested on suspicion of sexual assault

A 41-year-old man from Watermead, arrested on suspicion of sexual assault

Aylesbury's MP reflects on first year in role

Aylesbury's MP reflects on first year in role

Three Men Charged in Connection with Aggravated Burglary in Broughton

Three Men Charged in Connection with Aggravated Burglary in Broughton

UPDATE: Emergency Road Closure on A413 Great Missenden

UPDATE: Emergency Road Closure on A413 Great Missenden